Caixa Geral De Depsitos SWIFT Code Guide for Global Transfers

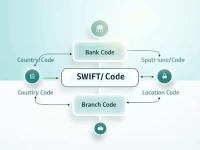

This article analyzes the SWIFT code CGDIPTPL OSF of CAIXA GERAL DE DEPOSITOS and its application and precautions in international remittances. It aims to help readers understand the impact of transaction fees, processing time, and exchange rates on the remittance process, enhancing the efficiency and security of international money transfers.